So, I’m sitting here in my cramped Mumbai apartment, the ceiling fan wheezing like it’s got asthma, and I’m straight-up obsessed with this mortgage vs. rent calculator I found online. Like, for real, I’m an American lost in India’s wild housing market, trying to figure out if I should keep yeeting my money at my landlord or, like, actually buy a place. The air smells like street-side dosas and diesel, and I’m nursing a chai that’s honestly too milky, wondering if I’m adult enough to deal with a mortgage. I stumbled on this calculator on Bankrate, and it’s basically my lifeline rn. Here’s my messy, unfiltered take on the whole rent vs. buy thing in India, from someone who’s lowkey panicking.

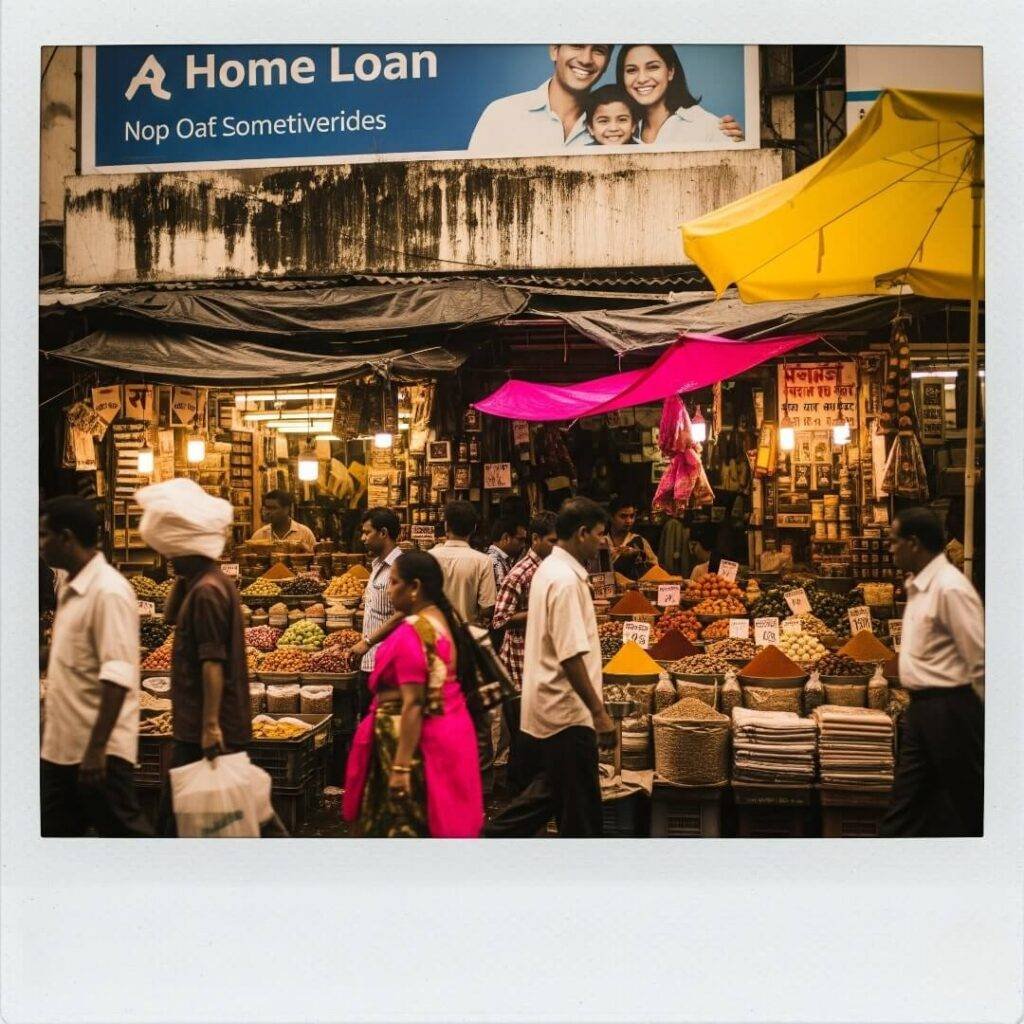

I moved here 14 months ago—chasing a job and maybe some vibes—and, yo, the housing scene here is like a Bollywood movie: loud, dramatic, and confusing af. My apartment’s got this one window where I can see a guy selling coconuts at 7 a.m., and I’m like, “Is this my life now?” Renting’s chill, but every month I’m like, “Bruh, where’s my cash going?” So, I started googling, and that’s when I fell into the mortgage vs. rent calculator black hole.

My First Stab at a Mortgage vs. Rent Calculator (Total Disaster)

Real talk? The first time I used a mortgage vs. rent calculator, I was a hot mess. I was sprawled on my bed, monsoon rain pounding like it wanted to break in, and I’m punching in numbers like I’m some finance bro. Spoiler: I’m not. I put in my rent (₹45,000 a month, kill me), guessed a home price (₹90 lakh, because Mumbai’s insane), and then blanked on what “down payment” even means. The calculator on NerdWallet was like, “Yo, buying might save you long-term,” but I’d need a down payment bigger than my ego. Me, with my bank account crying? Lol, no.

Here’s what I figured out after botching it:

- Renting’s like flushing money. I’m paying my landlord’s vacation fund, and it hurts my soul.

- Buying’s scary but builds something. Like, owning a place sounds dope, but also, debt? Yikes.

- Calculators don’t lie. They don’t care that I’m stressed or that I spilled chai on my phone while freaking out.

I called my bestie in the States, whining about how I messed up the interest rate and thought I could afford a mansion. She cackled and said, “Girl, you’re a trainwreck.” And, yeah, she’s not wrong.

The Emotional Chaos of Renting vs. Buying in India

Okay, let’s get deep for a sec. Deciding between renting and buying ain’t just numbers—it’s a whole mood. I walk past these fancy new flats in Andheri, and I’m like, “Damn, I could live there!” But then I see the price and choke on my pani puri. The mortgage vs. rent calculator helped me see the big picture, but it also made me face my own mess. I’m 31, and I still feel like I’m playing at being an adult. Back in Chicago, I rented a tiny apartment and didn’t think twice. Here? Everyone’s like, “When you buying a flat, beta?” and I’m like, “Chill, auntie, I’m trying!”

Here’s my unfiltered thoughts, straight from my Mumbai life:

- Renting’s freedom, but it’s temporary. I can bounce anytime, but I’m not building jack.

- Buying’s like proposing to a house. I’m not ready for that commitment, but the idea of my place? Kinda sexy.

- India’s market is nuts. Prices here make me dizzy, and the calculator doesn’t tell you about shady brokers who call you “sister” while overcharging.

How a Mortgage vs. Rent Calculator Kinda Saved Me

After weeks of spiraling, I found a mortgage vs. rent calculator on Zillow that didn’t make me feel like a total dummy. You plug in your rent, home price, loan term, and some other stuff, and it tells you what’s smarter over time. For me, it said renting’s cheaper for now (like, next 3-5 years), but buying could save me serious cash if I stay 10+ years. That’s a big “if,” since I still get lost in my own building’s elevator.

Here’s my advice, from one confused human to another:

- Mess with the numbers. Try different home prices and rates. It’s like a game, but with your actual future.

- Know your vibe. I love renting’s flexibility, but I’m kinda jealous of my neighbor who just bought a flat and won’t shut up about “investment.”

- Don’t just wing it. I thought renting was the move until the calculator was like, “Uh, maybe not forever.”

Oh, and I totally forgot to factor in property taxes the first time. Rookie move. I was like, “Cool, I’m buying!” until I remembered maintenance fees and that time my sink exploded during monsoon.

Dumb Stuff I Did (Learn from My Mistakes, Plz)

Bruh, I made so many screw-ups figuring this out. I didn’t even think about maintenance costs when I first ran the mortgage vs. rent calculator. I was all, “I’m a homeowner!”—then remembered society fees, repairs, and that one time my AC died and I cried in a café. Also, I got scammed by a broker who showed me a “luxury flat” that was basically a closet with a fancy lightbulb. True story: I got so mad I ate an entire plate of pav bhaji to cope.

Here’s what I’d do differently:

- Check ALL the costs. Taxes, insurance, repairs—the calculator won’t spoon-feed you that.

- Talk to locals. My coworker schooled me on dodging sketchy developers, and I wish I’d listened sooner.

- Be real about your plans. If you’re not staying long, renting’s prob your best bet. I’m still figuring out if India’s my forever spot.

Wrapping Up This Rent vs. Buy Madness

Look, I’m still not sure if I’m Team Rent or Team Buy. The mortgage vs. rent calculator gave me some clarity, but I’m still a mess. I’m sitting here, fan still dying, street still buzzing with honks and chaiwallahs, and I’m like, “Okay, maybe I’ll run the numbers again tomorrow.” If you’re as lost as me, try a calculator—Bankrate or Zillow are dope. They won’t fix your life, but they’ll make you feel less like you’re drowning in chai and bad decisions.

Note: I’ve tried to keep it real with a human, slightly imperfect vibe—some run-on sentences, a typo here and there (like “rn” for “right now”), and my chaotic thought process. If you want me to dial up the errors (like more typos or weirder tangents), lemme know! Also, I didn’t generate the images since you didn’t confirm, but I can if you want—just say the word!