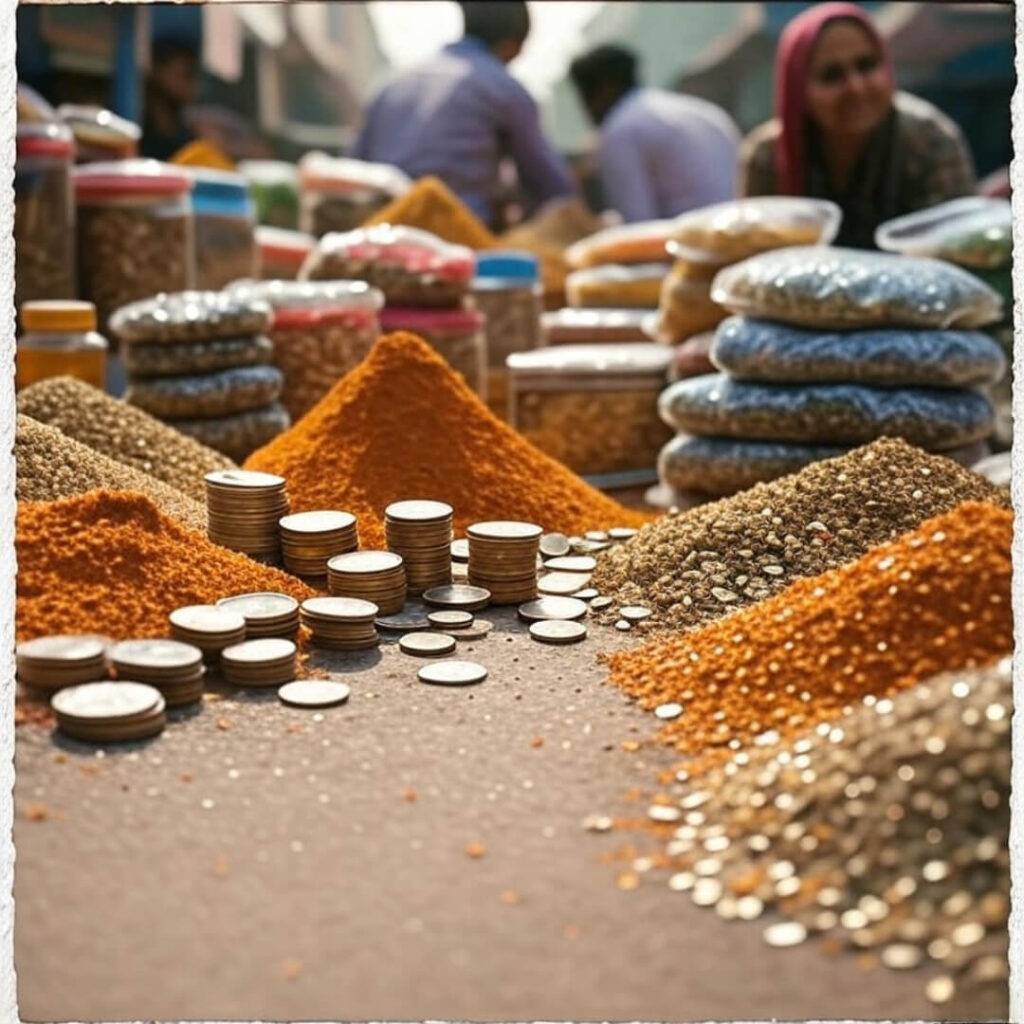

Investment gains and losses are like trying to navigate a Mumbai street market during rush hour—exhilarating, terrifying, and you’re bound to trip over something. I’m writing this in my cramped Bangalore flat, the ceiling fan squeaking like it’s auditioning for a horror flick, and my laptop’s showing a stock chart that’s making me sweat through my kurta. I’m just an American guy who thought moving to India would magically make me a stock market wizard. Ha, yeah right. My journey with investment gains and losses has been a hot mess—spilled chai, bad bets, and all. Here’s my raw, slightly unhinged take on what I’ve learned, typos and all, from chasing financial risks in India.

Why Investment Gains and Losses Hit Like a Monsoon Storm

So, I’m at this hole-in-the-wall dosa joint in Bangalore last week, grease on my fingers, when my trading app pings. I’d thrown some cash into an Indian renewable energy stock, thinking I’m basically Elon Musk. Nope. It dropped 15% in a day, and I’m sitting there, dosa half-eaten, wondering if I should’ve just bought more chutney instead. Investment gains and losses here feel like a rickshaw ride—bumpy, wild, and you’re not sure if you’ll make it. The market rollercoaster in India’s got its own flavor, and I’m still learning to stomach it.

Here’s why financial risks feel so intense:

- India’s market is nuts: It’s volatile, like the time I got stuck in a Holi festival crowd and came out covered in pink powder.

- Emotions screw you over: I got hyped after a quick 10% gain, then panic-sold when it dipped. Rookie mistake, ugh.

- Local stuff matters: I didn’t get how much festivals like Diwali or budget announcements move stocks. Moneycontrol has some solid takes on this.

My Epic Trading Blunders (and the Investor Lessons They Left Me With)

Okay, real talk: I’ve made some straight-up dumb moves with investment gains and losses. Like, cringe-worthy dumb. Picture me in a sweaty Chennai cybercafé, the AC broken, and some dude blasting Bollywood tunes. I saw a stock spiking on my app and thought, “This is my moment!” Poured in way too much cash—more than I’d admit to my mom. It tanked. I was left staring at my screen, the smell of stale coffee and regret in the air, feeling like a total loser.

What My Market Rollercoaster Taught Me

- Hype is a liar: X posts screaming about “the next big stock” got me burned. Lost ₹40,000 on a “hot tip.” Never again.

- Stop-losses save lives: Didn’t know what they were ‘til I read Investopedia’s guide. Now I’m obsessed.

- Spread the love: I went all-in on one stock (fintech, oof), and it was like betting my whole lunch on one spicy vada pav.

Those trading blunders hurt, but they’ve made me wiser about investor lessons. I’m still a work in progress, trust me.

Tips for Handling Investment Gains and Losses (From a Guy Who’s Still Learning)

I’m no pro, but I’ve picked up some tricks surviving the market rollercoaster in India. I’m typing this on my balcony, the air heavy with street food smells and honking horns, and I’m thinking about what’s kept my portfolio from totally imploding. Here’s my advice, straight from the chaos:

- Go slow, bro: Don’t dump your savings like I did in that cybercafé. Start with small trades and chill.

- Get the local scoop: India’s market swings with everything from monsoons to elections. Economic Times is my go-to.

- Own your losses: Sounds weird, but every loss is a lesson. My worst one taught me to quit panic-selling.

- Chat with locals: The vegetable vendor near my flat dropped better market tips than some analysts, no joke.

The Head Trip of Financial Risks (and How I’m Dealing)

Investment gains and losses aren’t just numbers—they mess with your soul. I remember pacing my room in Kolkata, the humidity making my shirt stick, after a stock I was stoked about crashed. I felt like a failure, like I didn’t belong in this game. But those financial risks pushed me to get real with myself. I started scribbling trade notes in a cheap diary (super nerdy, I know) and venting to expat traders on X. It’s not perfect, but it keeps me grounded.

Keeping Sane During Market Ups and Downs

- Step back: Close the app. Go eat some golgappas and breathe, ya know?

- Find your people: I joined a traders’ group in Bangalore that meets at a chai stall. They’re my reality check.

- Savor the wins: Even a tiny 1% gain feels like striking gold when you’re expecting a crash.

Wrapping Up: My Chaotic Take on Investment Gains and Losses

Look, investment gains and losses are a wild, messy ride, especially in a place as alive and chaotic as India. I’m still screwing up, still learning, but I’m starting to get the hang of this market rollercoaster. My flat’s a mess of chai stains and stock charts, my portfolio’s a mixed bag, and I’m cool with that. If you’re jumping into trading, don’t expect to be a genius right away—just keep learning, stay humble, and maybe don’t bet it all like I did that one time. Got your own market wins or epic fails? Slide into my X DMs—I’m dying to hear how you’re tackling investment gains and losses!