Choosing the best health insurance for 2025 can feel like solving a puzzle with missing pieces. With options like COBRA, the ACA Marketplace, and employer-sponsored plans, how do you decide what’s right for you? Whether you’re transitioning jobs, seeking affordable coverage, or weighing costs, this guide breaks down each option to help you make an informed choice. Let’s dive into the pros, cons, and real-world scenarios to find the ideal health insurance for 2025.

What Is COBRA? Is It the Best Health Insurance for 2025?

COBRA (Consolidated Omnibus Budget Reconciliation Act) allows you to continue your employer’s health plan after leaving a job, typically for up to 18 months. It’s a lifeline for maintaining familiar coverage, but is it the best health insurance for 2025?

How COBRA Works

- Eligibility: Available if you lose employer coverage due to job loss, reduced hours, or certain life events.

- Cost: You pay the full premium (employer + employee share), plus a 2% admin fee—often 3-4 times pricier than before. For example, a family plan might cost $1,500/month.

- Coverage: Identical to your previous employer plan, including doctors and prescriptions.

Pros of COBRA in 2025

- Seamless transition with no coverage gaps.

- Keeps your existing doctors and network.

- Ideal for short-term needs (e.g., between jobs).

Cons of COBRA

- High costs can strain budgets.

- Temporary coverage (18-36 months max).

- No subsidies to offset premiums.

Real-World Example: Sarah, a 35-year-old marketer, lost her job in 2024. She opted for COBRA to maintain her trusted doctors while job hunting. However, the $1,200 monthly premium prompted her to explore other options after six months.

Outbound Link: U.S. Department of Labor COBRA Guide for detailed eligibility rules.

ACA Marketplace: Affordable and Flexible Health Insurance for 2025

The ACA Marketplace (Healthcare.gov) offers individual and family plans with subsidies based on income. For many, it’s a strong contender for the best health insurance in 2025 due to its affordability and variety.

How the Marketplace Works

- Enrollment: Open Enrollment for 2025 runs from November 1, 2024, to January 15, 2025. Special Enrollment Periods apply for life events like job loss.

- Cost: Premiums vary by plan tier (Bronze, Silver, Gold, Platinum). Subsidies can lower costs significantly for households earning 100-400% of the federal poverty level.

- Coverage: Plans cover essential benefits like hospitalization, prescriptions, and preventive care.

Pros of Marketplace Plans

- Subsidies make premiums affordable (e.g., a family of four earning $50,000 might pay $200/month).

- Wide range of plans to match your needs.

- Option to shop for better coverage annually.

Cons of Marketplace Plans

- Limited provider networks compared to employer plans.

- Subsidies depend on income, so changes can affect costs.

- Enrollment deadlines require planning.

Real-World Example: Mark, a freelancer, enrolled in a Silver Marketplace plan for 2025. With subsidies, his premium dropped to $150/month, saving him $400 compared to COBRA. However, he had to switch doctors due to network restrictions.

Outbound Link: Healthcare.gov for enrollment details and subsidy calculators.

Employer-Sponsored Plans: The Gold Standard for 2025?

Employer-sponsored plans remain a popular choice for the best health insurance in 2025, especially for those with stable jobs. These plans often balance cost and coverage effectively.

How Employer Plans Work

- Eligibility: Offered to full-time employees, often with family coverage options.

- Cost: Employers typically cover 50-80% of premiums, leaving employees with manageable costs (e.g., $200-$400/month for a family).

- Coverage: Comprehensive, with broad networks and benefits like dental or vision add-ons.

Pros of Employer Plans

- Employer contributions lower out-of-pocket costs.

- Wide provider networks and plan options.

- Automatic enrollment simplifies the process.

Cons of Employer Plans

- Limited to job status—lose your job, lose coverage.

- Less flexibility to customize plans.

- Premiums can still be high for families.

Real-World Example: Lisa, a teacher, relies on her employer’s plan, which costs $250/month for her family. The broad network lets her keep her pediatrician, but she wishes for more flexibility in plan design.

Outbound Link: Kaiser Family Foundation’s 2024 Employer Health Benefits Survey for data on employer plan trends.

Comparing COBRA, Marketplace, and Employer Plans for 2025

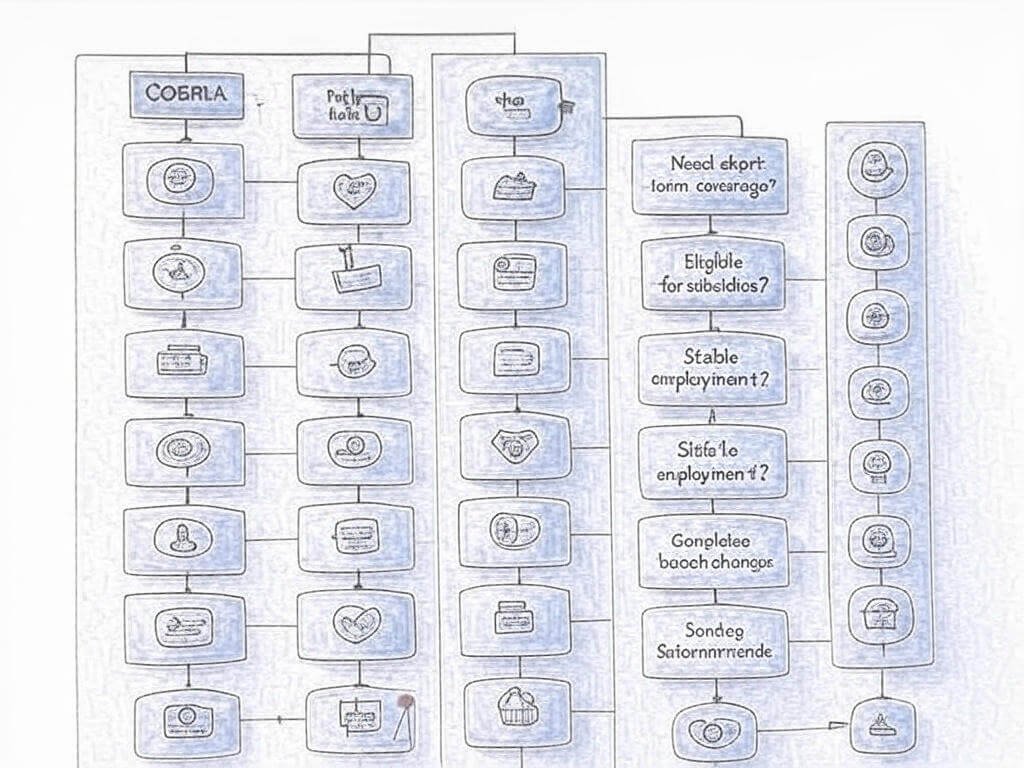

To find the best health insurance for 2025, consider your priorities. Here’s a quick comparison:

| Factor | COBRA | Marketplace | Employer Plan |

|---|---|---|---|

| Cost | High (full premium) | Subsidized, affordable | Employer-subsidized |

| Coverage | Same as employer plan | Essential benefits | Comprehensive, broad networks |

| Flexibility | Low (fixed plan) | High (multiple plans) | Medium (employer-selected) |

| Best For | Short-term transitions | Freelancers, low-income | Stable employees |

Data Insight: According to the Kaiser Family Foundation, 59% of workers had employer-sponsored coverage in 2024, while 6% used Marketplace plans, and 1% relied on COBRA.

How to Choose the Best Health Insurance for 2025

Selecting the best health insurance for 2025 depends on your circumstances. Follow these steps:

- Assess Your Needs:

- Do you need specific doctors or prescriptions?

- How long will you need coverage?

- What’s your budget?

- Compare Costs:

- Use Healthcare.gov’s subsidy calculator for Marketplace plans.

- Check COBRA premiums with your former employer.

- Review employer plan contributions.

- Evaluate Networks:

- Ensure your preferred providers are in-network.

- Marketplace plans may have narrower networks than employer plans.

- Plan for the Future:

- If jobless, COBRA or Marketplace may bridge gaps.

- Stable employment? Employer plans often win for cost and coverage.

Actionable Tip: Use tools like eHealthInsurance.com to compare plans side-by-side for cost and coverage.

2025 Trends Impacting Your Health Insurance Choice

Healthcare is evolving, and 2025 brings new considerations for the best health insurance:

- Telehealth Expansion: Employer and Marketplace plans increasingly cover virtual visits, ideal for remote workers.

- Rising Premiums: COBRA and unsubsidized plans may see 5-7% cost increases, per industry forecasts.

- Policy Changes: Potential ACA subsidy expansions could make Marketplace plans even more affordable.

Outbound Link: CMS.gov for updates on ACA policies and trends.

Conclusion: Finding Your Best Health Insurance for 2025

Whether COBRA, the Marketplace, or an employer-sponsored plan is the best health insurance for 2025 depends on your unique needs. COBRA suits short-term transitions, Marketplace plans offer affordability, and employer plans excel for stability. Weigh costs, coverage, and flexibility, and use tools like Healthcare.gov or eHealthInsurance.com to make an informed choice. Start planning now to secure the right coverage for a healthy 2025!