Navigating the world of health insurance can feel like solving a puzzle with missing pieces. Choosing the right health plan is crucial to ensuring you get the coverage you need without draining your wallet. With endless options, confusing jargon, and rising costs, it’s easy to feel overwhelmed. But don’t worry—this guide will break it all down into simple, actionable steps. Whether you’re a young professional, a growing family, or nearing retirement, you’ll learn how to pick a health plan that fits your needs and budget without losing your mind.

Why Choosing the Right Health Plan Matters

The wrong health plan can lead to unexpected medical bills, limited provider options, or coverage gaps. According to a 2023 Kaiser Family Foundation study, 43% of insured Americans struggled with medical debt due to inadequate plans. On the other hand, the right plan saves you money, reduces stress, and ensures access to quality care.

Step 1: Understand Your Health Needs

Before diving into plan options, assess your healthcare needs. Choosing the right health plan starts with knowing what you and your family require. Ask yourself:

- How often do you visit doctors? If you’re healthy and rarely need care, a high-deductible plan might work. Frequent visits? Look for low-copay plans.

- Do you have chronic conditions? Plans with robust prescription coverage are essential for managing ongoing conditions like diabetes.

- Are you planning for major life events? Expecting a baby or scheduling surgery? Prioritize plans with strong hospitalization benefits.

Real-World Example: Sarah, a 32-year-old freelancer, chose a high-deductible plan because she rarely visited doctors. But when she needed emergency surgery, her out-of-pocket costs skyrocketed. A plan with lower deductibles would’ve saved her thousands.

Actionable Tip: Make a list of your expected medical needs for the next year to guide your decision.

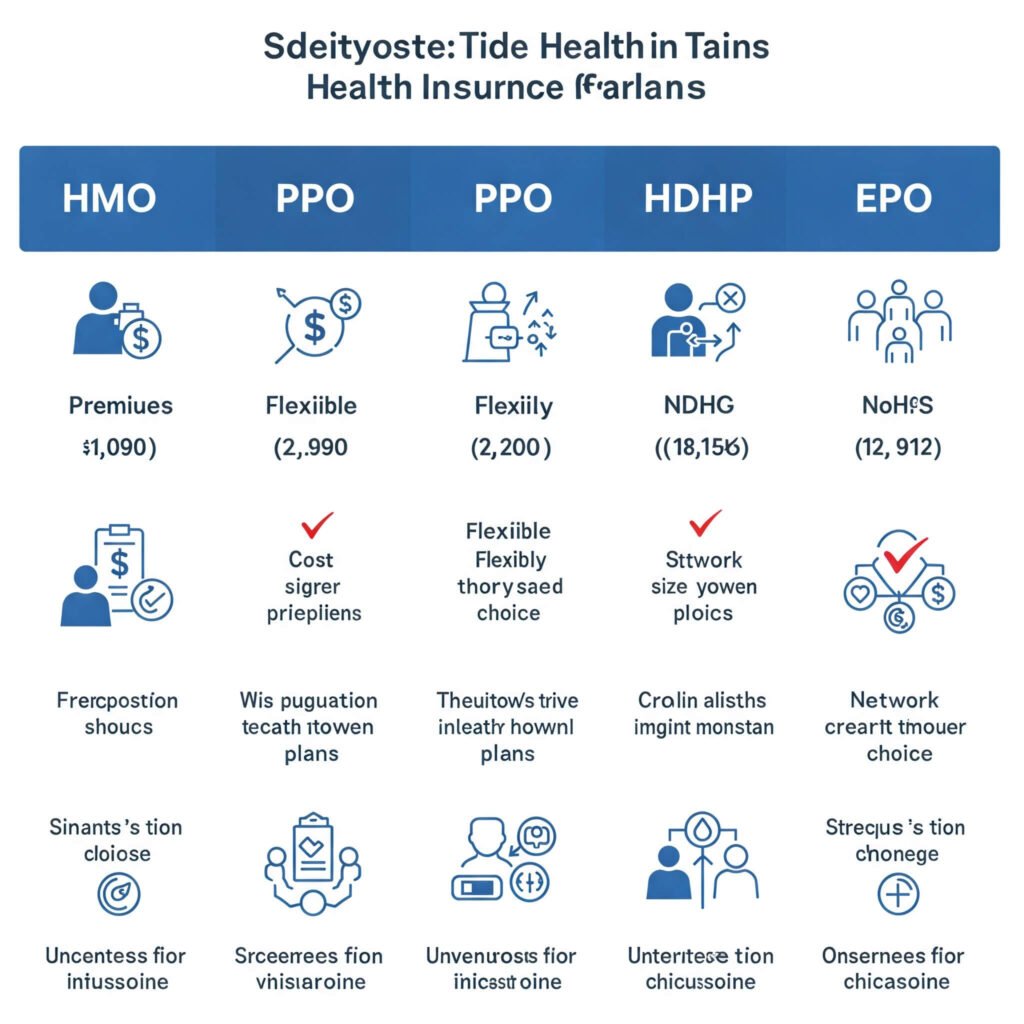

Step 2: Decode Health Plan Types

Health plans come in various flavors, each with pros and cons. Understanding these options is key to choosing the right health plan. Here’s a quick breakdown:

- HMO (Health Maintenance Organization):

- Pros: Lower premiums, predictable costs.

- Cons: Limited provider networks, requires referrals for specialists.

- Best for: Budget-conscious individuals who don’t mind staying within a network.

- PPO (Preferred Provider Organization):

- Pros: More provider flexibility, no referrals needed.

- Cons: Higher premiums and deductibles.

- Best for: Those who want freedom to see specialists or out-of-network doctors.

- HDHP (High-Deductible Health Plan):

- Pros: Low premiums, pairs well with HSAs (Health Savings Accounts).

- Cons: High out-of-pocket costs before coverage kicks in.

- Best for: Healthy individuals or those who want to save for future medical expenses.

- EPO (Exclusive Provider Organization):

- Pros: Lower costs, no referrals needed.

- Cons: No out-of-network coverage (except emergencies).

- Best for: Those who prefer a balance between HMO and PPO.

Outbound Link: For a deeper dive into plan types, check out HealthCare.gov’s guide.

Step 3: Compare Costs Beyond Premiums

When choosing the right health plan, don’t just focus on monthly premiums. Consider the total cost, including:

- Deductibles: The amount you pay before insurance kicks in.

- Copays/Coinsurance: Your share of costs for visits or services.

- Out-of-Pocket Maximum: The most you’ll pay in a year.

- Prescription Costs: Check if your medications are covered.

Data-Driven Insight: A 2024 Commonwealth Fund report found that 60% of Americans underestimated their total healthcare costs because they only looked at premiums.

Actionable Tip: Use online tools like eHealthInsurance.com to compare plans side by side, factoring in all costs.

Step 4: Check Provider Networks

A great plan is useless if your preferred doctors aren’t covered. When choosing the right health plan, verify:

- Is your doctor in-network? Call your provider or check the plan’s online directory.

- Are nearby hospitals included? Important for emergencies or planned procedures.

- What about specialists? Ensure access to cardiologists, oncologists, or other specialists you may need.

Real-World Example: Mark, a 45-year-old father, picked a plan with low premiums but later discovered his daughter’s pediatrician wasn’t in-network. Switching doctors disrupted her care and cost extra.

Step 5: Look for Extra Benefits

Some plans offer perks that can save money and improve care. When choosing the right health plan, explore:

- Telehealth Services: Virtual visits can save time and money.

- Wellness Programs: Discounts on gym memberships or smoking cessation programs.

- Preventive Care: Most plans cover screenings and vaccines at no cost—take advantage!

Outbound Link: Learn more about preventive care benefits at CDC.gov.

Common Mistakes to Avoid When Choosing a Health Plan

- Ignoring the Fine Print: Read the plan’s summary of benefits to avoid surprises.

- Choosing Based on Price Alone: Low premiums often mean higher out-of-pocket costs.

- Skipping Open Enrollment: Most plans only allow changes during specific periods. Mark your calendar!

- Not Asking for Help: Brokers or navigators can simplify the process for free.

Actionable Tip: Contact a certified insurance broker through NAHU.org for personalized guidance.

Final Thoughts: Take Control of Your Health Plan Choice

Choosing the right health plan doesn’t have to be a nightmare. By assessing your needs, understanding plan types, comparing costs, checking networks, and exploring benefits, you can find coverage that fits your life and budget. Take your time, use online tools, and don’t hesitate to ask for help. A little effort now can save you thousands—and your sanity—later