The 50/30/20 budget rule has been a cornerstone of personal finance for decades, offering a simple framework to manage money. Popularized by Senator Elizabeth Warren in her book All Your Worth, this rule divides your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings or debt repayment. But with rising living costs, gig economies, and evolving financial priorities, is the 50/30/20 budget rule still relevant in 2025? Let’s break it down, explore its strengths and limitations, and see how it fits into today’s world.

What Is the 50/30/20 Budget Rule?

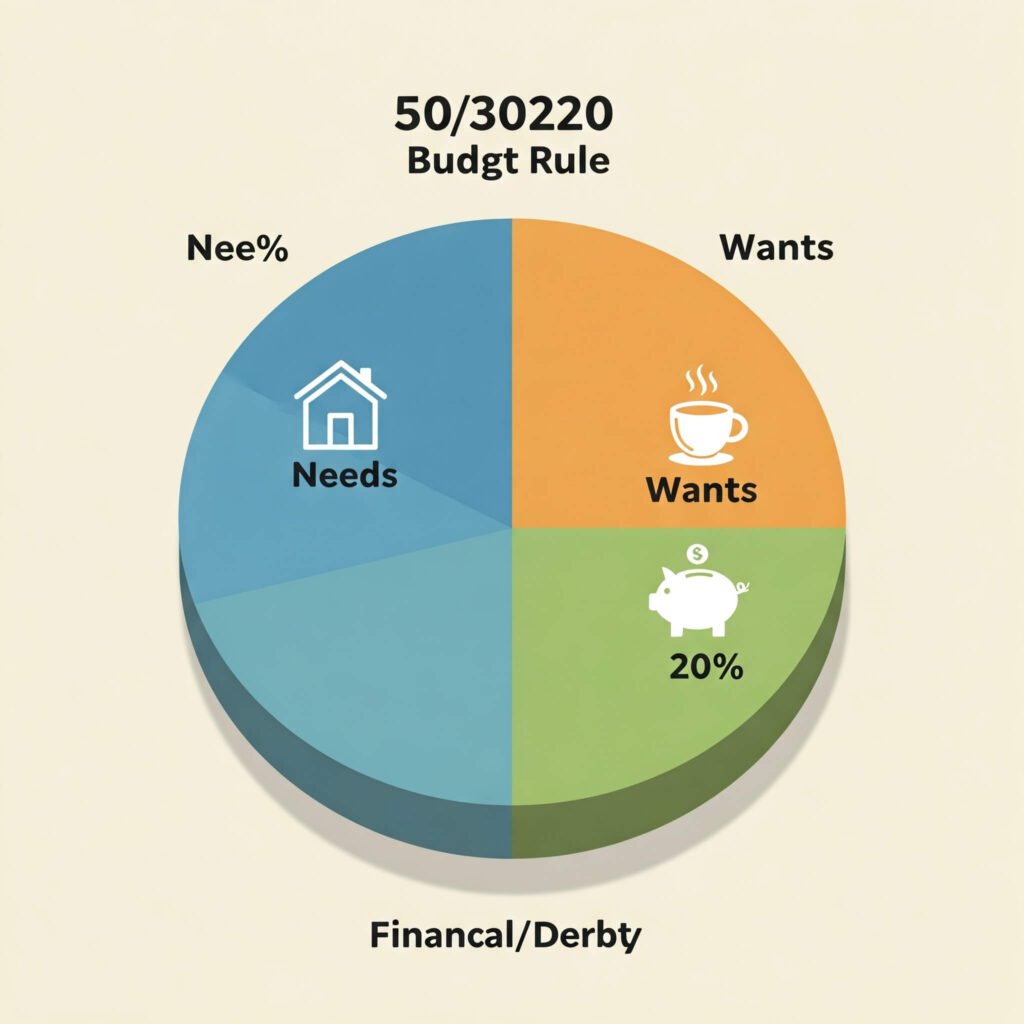

The 50/30/20 budget rule is a straightforward approach to financial planning. Here’s how it works:

- 50% Needs: Essential expenses like rent, utilities, groceries, and transportation.

- 30% Wants: Non-essential spending, such as dining out, entertainment, or hobbies.

- 20% Savings/Debt: Money allocated to savings, investments, or paying off debt.

This simplicity makes the rule appealing, especially for beginners. But does it hold up in 2025’s economic landscape?

Why the 50/30/20 Budget Rule Still Works in 2025

Despite changes in the financial world, the 50/30/20 budget rule remains a solid starting point for many. Here’s why:

Simplicity Drives Adoption

The rule’s clear structure makes budgeting approachable. For example, Sarah, a 28-year-old freelancer, used the 50/30/20 budget rule to organize her irregular income. By allocating 50% to rent and utilities, 30% to travel and subscriptions, and 20% to her emergency fund, she gained control over her finances.

Flexibility for Customization

The rule isn’t rigid. In 2025, you can tweak it to fit your lifestyle. For instance, if housing costs eat up 60% of your income, you can adjust the “wants” category to 20% and still prioritize savings.

Encourages Savings

With 20% dedicated to savings or debt repayment, the rule promotes long-term financial health. According to a 2024 NerdWallet survey, 60% of Americans lack a dedicated savings plan. The 50/30/20 budget rule offers a clear path to building that habit.

Challenges of the 50/30/20 Budget Rule in 2025

While the 50/30/20 budget has merits, it’s not one-size-fits-all. Here are some challenges in today’s economy:

Rising Cost of Living

In 2025, housing and healthcare costs continue to outpace income growth. A Forbes article notes that median rent in major U.S. cities often exceeds 50% of income for many households. This makes sticking to the 50% “needs” cap difficult.

Gig Economy and Irregular Income

Freelancers and gig workers face fluctuating incomes, complicating the rule’s fixed percentages. For example, a gig driver might earn $3,000 one month and $1,500 the next, making it hard to allocate 20% consistently to savings.

Evolving Financial Priorities

In 2025, priorities like student loan forgiveness, cryptocurrency investments, or side hustles may demand more than 20% of income. The rule doesn’t account for these modern complexities.

How to Adapt the 50/30/20 Budget Rule for 2025

To make the 50/30/20 budget rule work in 2025, consider these modern tweaks:

- Adjust Percentages Based on Income: If needs exceed 50%, reduce wants to 20% or 15%. For high earners, increase savings to 30% for faster wealth-building.

- Use Budgeting Apps: Tools like YNAB or Mint can track your 50/30/20 budget allocations in real-time, adapting to income fluctuations.

- Prioritize High-Impact Savings: Focus your 20% on high-yield savings accounts or investments. A 2025 Investopedia guide recommends index funds for long-term growth.

- Incorporate Side Hustles: Allocate side hustle income to savings or debt to maintain the rule’s balance during lean months.

- Reassess Regularly: Review your budget quarterly to adjust for life changes like job switches or rent increases.

Real-World Example: Mark, a 35-year-old teacher, modified the 50/30/20 budget to 60/20/20 because his mortgage consumed more than 50% of his income. By cutting subscriptions and dining out, he maintained 20% for retirement savings.

Is the 50/30/20 Budget Rule Right for You in 2025?

The 50/30/20 budget is still relevant in 2025, but its success depends on your circumstances. It’s ideal for:

- Beginners seeking a simple budgeting framework.

- Steady earners with predictable expenses.

- Those prioritizing savings and debt repayment.

However, it may not suit:

- Low-income households with high essential costs.

- Gig workers with irregular incomes.

- Individuals with complex financial goals, like early retirement.

Image Placeholder 3: A hopeful image of a person checking a budgeting app on their phone, symbolizing financial control. Place it here to inspire readers