Emotional investing? Yeah, that’s the beast that’s got me sweating bullets right here in Mumbai’s sticky September heat, where the humidity clings like a bad trade you can’t shake. I’m this American dude, plopped down in India for what was supposed to be a “gap year refresh” but turned into a full-on financial therapy session—sipping cutting chai from a roadside stall, phone buzzing with red alerts from the NSE, and my risk tolerance screaming like a rickshaw horn in traffic. Seriously, back home I’d crunch numbers like a pro, but out here? One whiff of street samosa spice and a market blip, and bam—I’m dumping shares faster than you can say “FII outflow.” It’s raw, it’s messy, and honestly, it’s taught me more about my own freakouts than any Wall Street webinar ever could. Like, who knew my “high tolerance” was just code for ignoring the pit in my stomach until it yawned into a crater?

My Gut-Wrenching Intro to Emotional Investing Amid Mumbai Madness

Picture this: It’s last Diwali, right? I’m crashing at a buddy’s flat in Bandra, the air thick with firecracker smoke and that sweet jalebi tang wafting up from the vendors below. I’d just wired some savings into Indian growth stocks—tech darlings, you know, the ones promising unicorn vibes—feeling all cocky like I’d cracked the code on emotional investing. My risk tolerance? Bulletproof, or so I thought. Then the global headlines hit: some Fed whisper about rates, and poof, my portfolio dips 15% overnight. I’m pacing the balcony, heart pounding louder than the Ganesh processions, yelling at my screen like it’s personally betrayed me. “Sell! No, hold! Wait, what?” Classic emotional investing trap— that rush of fear turning logical bets into knee-jerk disasters. And get this, in the chaos, I accidentally bought more of the loser stock. Facepalm. It was embarrassing, dude, like confessing to your mom you blew rent on crypto hype.

But here’s the kicker in all this emotional investing drama: risk tolerance isn’t some static number on a quiz—it’s this slippery eel that morphs with your mood, your masala dosa fullness level, even the jet lag fogging your American brain in humid India. I mean, stateside, I’d ride out dips with a beer and Netflix, but here? The constant buzz of street life amps everything—horns blaring, cows wandering into traffic—it mirrors that market volatility, making every tick feel like a personal gut punch. Anyway, digging into it later (after calming down with some forced breathing apps, ha), I realized my “tolerance” was lowballing itself because I was projecting home comforts onto foreign turf. Pro tip from my flop: Journal your freakouts pre-trade. Sounds lame? It saved my ass next round.

Spotting When Emotional Investing Hijacks Your Risk Tolerance

Oh man, let’s get real about those moments when emotional investing straight-up hijacks your risk tolerance—like, you’re all zen scrolling Bloomberg over filter coffee, then one bad earnings whisper and boom, you’re white-knuckling the sell button. Happened to me fresh off the plane in Delhi, jet-lagged and guzzling lassi to stay upright, when a blue-chip bank stock I’d eyed tanked on rumor alone. My brain? “This is it, total collapse!” Even though data screamed “buy the dip.” I froze, then overcompensated by chasing a sketchy penny stock tip from a WhatsApp group—pure thrill-seeking stupidity. Risk tolerance? More like risk illusion, fueled by that expat loneliness kicking in at 3 a.m. Seriously?, why do we do this? It’s wiring, I guess—evolution prepping us for saber-tooths, not Sensex swings.

- Fear mode alert: That icy sweat when charts bleed red? Pause, chug water (or chai), and ask: Is this data or drama dictating my investment decisions?

- Greed glitch: The FOMO high from a hot tip? Counter it by listing three reasons it’d flop—keeps emotional investing from turning you into a meme stock chaser.

- Contradiction corner: Ironically, my “cautious” days here in India led to missing gems, while panic sells bit me harder. Balance is bogus; it’s about knowing your chaos threshold.

For the nerdy deets, check out Investopedia’s breakdown on behavioral finance—it nailed why my risk tolerance flips like a monsoon switch. And yeah, I bookmarked Vanguard’s risk tolerance quiz after that Delhi debacle; took it thrice, got three different scores. Flawed? Totally. Helpful? Weirdly, yes.

Flipping the Script: Taming Emotional Investing with Real-Talk Risk Tolerance Hacks

Alright, fast-forward to now—I’m holed up in a Kochi beach shack, waves crashing like undervalued assets waiting for the tide, forcing myself to unpack how risk tolerance shapes every emotional investing move. Last week, I almost bailed on a steady dividend play because Instagram finfluencers were hyping meme coins. Gut said “yolo,” but I remembered my Mumbai meltdown and dialed back—set a hard stop-loss, not based on fear, but facts. Boom, the stock rebounded, and I pocketed gains without the ulcer. It’s not magic; it’s admitting your American ego (mine’s a beast) clashes with India’s patient market vibes. Like, back home we’d day-trade like maniacs, but here? HODL feels like karma yoga. Digression: The shack’s fan is whirring lazy circles, stirring salt air that smells like opportunity mixed with regret—perfect backdrop for rethinking investment decisions.

My biggest “aha” flop? Treating risk tolerance like a personality test instead of a daily gut check. Early on, I aced online quizzes as “aggressive,” so I dove into volatile small-caps. Cue the 2024 correction—I’m in a Goa trance party (don’t judge), phone dying, watching losses stack like empty beer cans. Woke up vowing “no more emotional investing!” Then broke it by revenge-trading the next morning. Self-deprecating truth: I’m still that guy, contradictions and all. But here’s my hack list, born from beachside brooding:

- Mood-map your trades: Before clicking buy, rate your vibe 1-10. Under 5? Step away—emotional investing loves low-energy traps.

- India-inspired buffer: Adopt a “rupee rainy day” fund—20% cash, just in case monsoon (literal or market) hits. Saved me from panic last budget season.

- Accountability buddy: Text a friend your thesis pre-trade. Mine’s a local CA who roasts my hype—keeps risk tolerance honest.

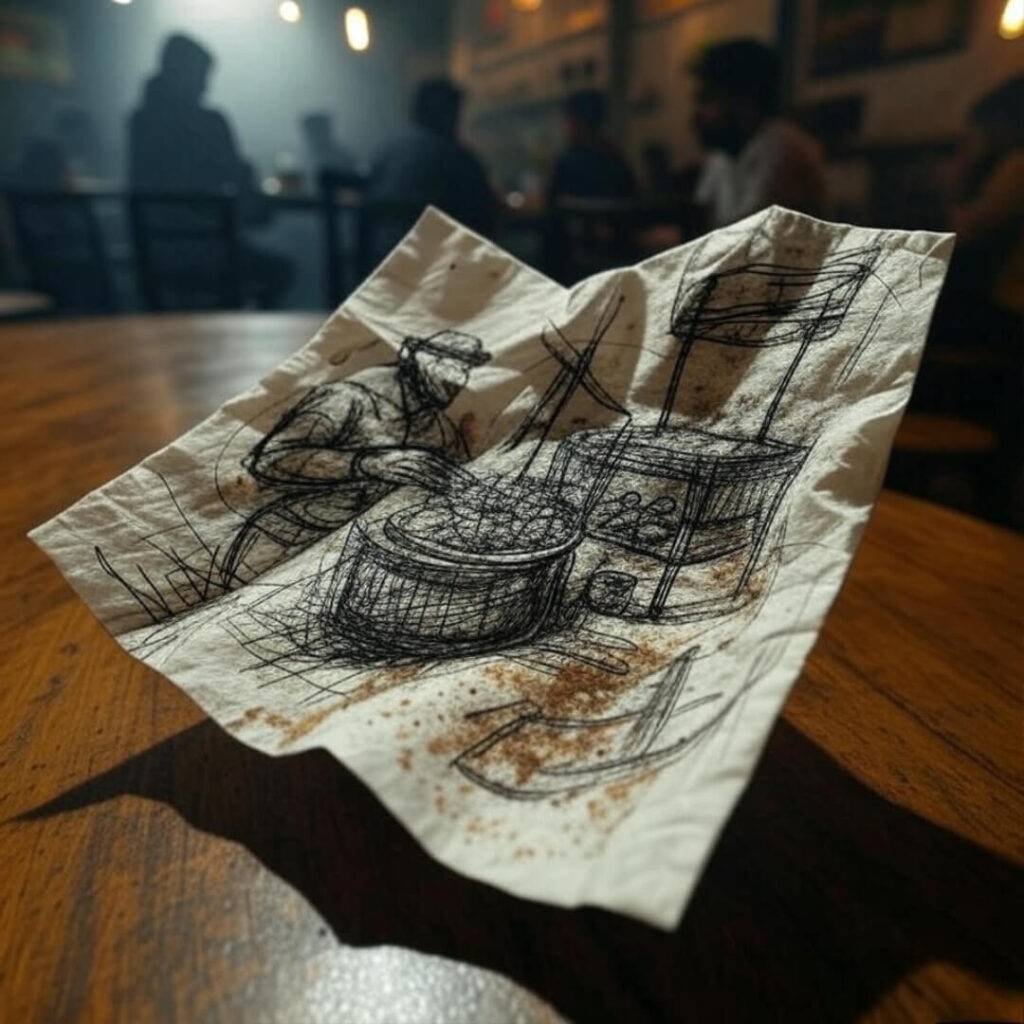

Wanna level up? Dive into NerdWallet’s guide on emotional biases in investing—it’s got charts that mirror my scribbled napkins. Oh, and SEBI’s investor education hub for that India-specific edge; as a foreigner, it humbled my know-it-all ass.

Wrapping This Emotional Investing Rant: Your Turn to Spill

Whew, typing this out from Kochi’s salty breeze, I gotta say—emotional investing and its risk tolerance tango has me equal parts wiser and wearier, like that one uncle at family reunions who overshares but drops truth bombs. I’ve botched trades that’ll haunt my tax returns, laughed off near-misses over thali plates, and yeah, even high-fived myself for not total imploding. It’s all flawed, all human, especially when your American hustle meets India’s slow-burn wisdom. Bottom line? Own your quirks, question the rush, and remember: Markets rise for the patient, not the panicked.

Hey, if this hit home—your own emotional investing war stories, drop ’em in the comments. What’s your risk tolerance kryptonite? Or better yet, grab a chai, quiz yourself, and share how you’d tweak my hacks. Let’s chaos this convo together—no judgments, just real talk. What’s one trade you’d redo right now?